Excellent News To Picking Bohemia Gold

Excellent News To Picking Bohemia Gold

Blog Article

What Factors Should I Take Into Consideration When Purchasing Gold Bullion Or Coins From The Czech Republic?

If you are considering investing in bullion or gold coins in the Czech Republic you should consider several factors. Accredited dealers and institutions ensure authenticity and high-quality.

Purity and Weight - Check purity and weight. Gold bullion comes in various weights and purity levels (e.g. 22, 24, etc.). Verify that it meets standards.

Pricing and Premiums- Learn the pricing structure that governs the spot price of gold and any premiums that dealers charge. Compare prices between various sellers to make sure you get the highest return on your investment.

Security and Storage- Consider safe and secure storage options for your gold. Certain investors prefer to store their gold at a bank, or at an establishment that is specifically designed to meet security issues.

The liquidity of the coins and options for selling- Check out how easy it is to sell them when necessary. Choose coins and bullion which are very liquid and simple to trade on the market. See the most popular the full details for buy Britannia coins for blog recommendations including gold penny, gold coin store near me, gold investment firms, gold quarter 2000, 1oz gold eagle coin, kruger rand, gold one dollar coin, invest gold ira, silver stocks price, $5 gold piece and more.

What Can I Do To Ensure The Gold Coin I Purchase Is Of Good Quality? Or Bullion I Buy In The Czech Republic?

Verifying the authenticity and documentation of gold bullion as well as coins from the Czech Republic includes several steps.-

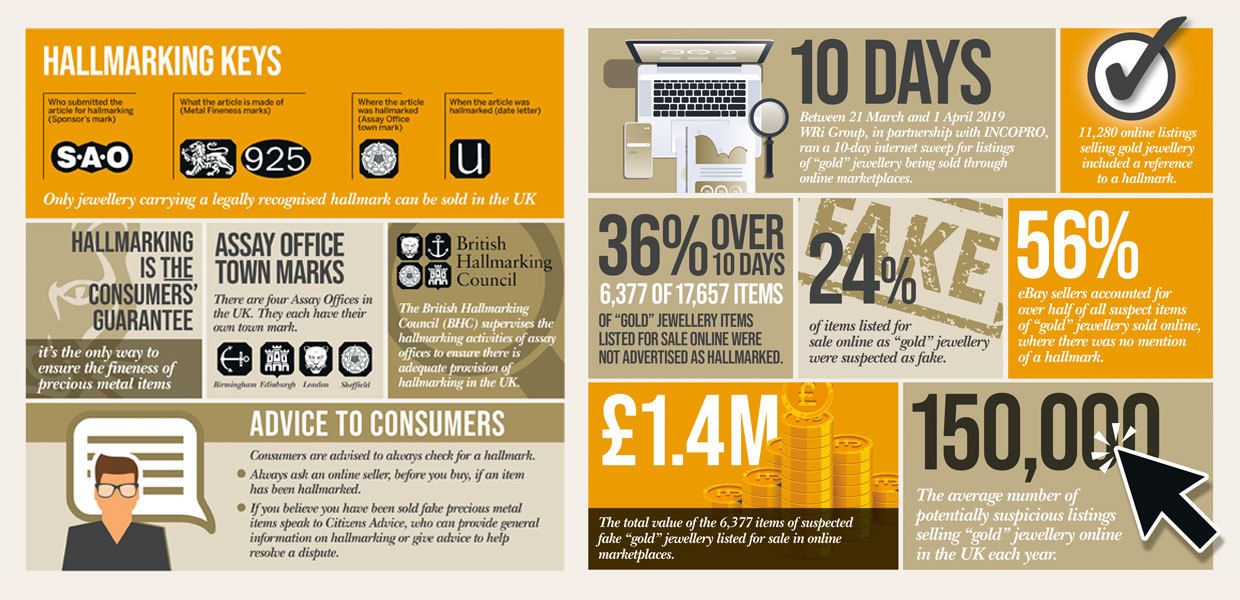

Hallmarks and certificationsFind stamps or hallmarks recognized by the government on the gold product. These hallmarks signify the weight, purity, and authenticity of the gold. They are typically provided by reputable assay offices, or by government institutions. Purity Check- Verify the purity of gold using markings that indicate the fineness, or karatage. Also 24 karat gold can be described as pure whereas lower karatages can be evidence of different degrees of alloying.

Reputable Sellers: Purchase gold from reputable and established dealers, or from authorized sellers. They offer documentation, including authentic certificates and purchase receipts with specifications.

Ask for documentation - If you're purchasing gold, request the certificates of authenticity or of assay. These documents should contain details about the purity, weight and manufacturer of the gold.

Independent Verification - Get an appraisal that is independent from an appraiser or professional. They will be able to assess the authenticity and quality of gold.

The verification of the authenticity and quality of gold bullion coinage requires a mixture of due diligence, and relying on reputable sources, and having the right documentation. Follow the best buy gold bars Britannia info for more tips including buy gold coins near me, gold quarter dollar, best gold ira, twenty dollar coin, gold quarter dollar, gold bullion for sale, purchase gold bar, ira investing gold, silver price in dollar, sovereign british coin and more.

What Is The Low Price Spread And What Is A Markup On The Price Of Gold On The Stock Exchange?

In the world of gold trading Low price markups and spreads are the expenses involved in purchasing or selling gold when compared to market prices. These terms describe the amount you'll pay for the gold, whether as an increase or spread. Low Mark-up: It is a small amount of money that the dealer adds to the gold market price. Low markup signifies that the price of gold you pay is close to or barely higher than its actual market value.

Low Price SpreadPrice spread is the difference between the selling and buying prices (ask and bid) for gold. A small price difference is indicative of an even wider spread between these two prices.

How Much Does The Markup And Price Among Gold Dealers?

The price spreads and mark-ups for gold are subject to significant variation among different dealers due to various factors, including their business models, operational costs, reputation, and pricing strategies. These are some general details about the variation:- Dealer reputation and service quality- A well-known and trusted dealer may charge higher prices due to perceived quality, customer service and reliability. In contrast, less established or newer dealers may have lower markups to draw customers.

The business model and overhead costsDealers that offer premium services or physical storefronts might have higher overhead costs to cover. Therefore, they will increase their prices to pay for their costs. Sellers on the internet or who have lower operational costs could provide a more competitive price.

Pricing Transparency - Dealers that have clear pricing usually offer lower markups and smaller spreads in order to attract clients who are looking for fair and clear pricing.

Due to these factors that gold buyers should conduct careful analysis and compare prices with different dealers. It is also important to look at other aspects aside from margins and markups like reliability, customer service and reputation when choosing the right dealer. Looking around and obtaining quotes from a variety of sources can help determine reasonable prices for purchases of gold. Follow the best his comment is here on gold bars Maple Leaf for more info including silver nickel, investing ira gold, barrick stocks, gld shares, best way to buy gold for investment, buying gold, st gaudens gold coin, 2000 sacagawea, ancient coin, gold bullion for sale and more.